Embark on a journey into the realm of automating taxes with QuickBooks for solo entrepreneurs. This introduction sets the stage for a deep dive into streamlining tax processes with QuickBooks in a comprehensive and efficient manner.

Exploring the benefits, setup process, and features tailored for solo entrepreneurs, this guide offers valuable insights into maximizing efficiency and accuracy in tax management.

Introduction to QuickBooks for Solo Entrepreneurs

QuickBooks is a popular accounting software that offers numerous benefits for solo entrepreneurs looking to streamline their financial management processes. With its user-friendly interface and powerful features, QuickBooks can help solo entrepreneurs stay organized, save time, and make informed decisions regarding their finances.

Benefits of Using QuickBooks

- Efficiency: QuickBooks automates many financial tasks, saving solo entrepreneurs valuable time.

- Accuracy: By eliminating manual data entry errors, QuickBooks helps ensure that financial records are accurate.

- Organization: QuickBooks allows solo entrepreneurs to keep all their financial information in one place, making it easy to track income, expenses, and taxes.

Streamlining Tax Processes

QuickBooks simplifies tax processes for solo entrepreneurs by providing tools to easily track deductible expenses, generate financial reports, and organize receipts. This can save time and reduce the stress of tax season, allowing solo entrepreneurs to focus on growing their business.

Features for Solo Entrepreneurs

- Invoicing: QuickBooks allows solo entrepreneurs to create and send professional invoices to clients, helping them get paid faster.

- Expense Tracking: Solo entrepreneurs can easily track business expenses, categorize them, and attach receipts for easy reference.

- Financial Reports: QuickBooks provides detailed financial reports that give solo entrepreneurs insights into their business performance.

Setting Up QuickBooks for Tax Automation

When it comes to automating taxes using QuickBooks as a solo entrepreneur, setting up your account correctly is crucial for accurate and efficient tax management. This involves linking your bank accounts, categorizing transactions, and ensuring all data entry is precise.

Linking Bank Accounts and Categorizing Transactions

Before you can automate your taxes in QuickBooks, you need to link your bank accounts to the platform. This allows QuickBooks to automatically import your financial transactions, saving you time and reducing the risk of manual errors. Once your accounts are linked, it's essential to categorize transactions correctly to ensure accurate tax reporting.

- Go to the Banking tab in QuickBooks and select "Link Account" to connect your bank account securely.

- Review and categorize each transaction based on the type of income or expense it represents.

- Set up rules in QuickBooks to automatically categorize recurring transactions for future reference.

Importance of Accurate Data Entry

Accurate data entry is the backbone of tax automation in QuickBooks. Any errors or discrepancies in your financial records can lead to incorrect tax calculations and potential penalties. Therefore, it's crucial to pay attention to detail and ensure all information entered into QuickBooks is precise and up-to-date.

Remember, the accuracy of your tax filings depends on the quality of data you input into QuickBooks.

Automating Income Tracking

Automating income tracking using QuickBooks can significantly streamline the process for solo entrepreneurs, making it easier to monitor revenue, invoicing, and overall financial health. By leveraging QuickBooks' features, solo entrepreneurs can save time and reduce the risk of errors in income tracking.

Setting Up Income Categories

- Begin by categorizing your income streams in QuickBooks based on your business activities, such as product sales, service fees, or consulting revenue.

- Customize income categories to align with your specific business needs and reporting requirements for accurate tracking.

Automated Invoicing

- Utilize QuickBooks' automated invoicing feature to generate and send invoices to clients promptly, ensuring timely payment collection.

- Set up recurring invoices for regular clients to automate the billing process and improve cash flow management.

Integration with Payment Processors

- Link your payment processors, such as PayPal or Stripe, to QuickBooks for seamless income tracking and reconciliation of transactions.

- Syncing payment data with QuickBooks eliminates manual data entry and reduces the risk of discrepancies in financial records.

Automating income tracking in QuickBooks not only saves time but also provides accurate financial data for tax preparation, financial analysis, and decision-making.

Streamlining Expense Management

In order to effectively manage and track expenses as a solo entrepreneur, it is crucial to streamline the process using QuickBooks. By automating expense tracking and categorizing expenses properly, you can save time and ensure accuracy in your financial records.

Automating Expense Tracking

To automate expense tracking in QuickBooks, follow these steps:

- Set up bank feeds: Connect your business bank account to QuickBooks to automatically import transactions.

- Create rules: Establish rules for categorizing expenses based on s, vendors, or amounts.

- Use receipt capture: Utilize QuickBooks' receipt capture feature to easily upload and attach receipts to expenses.

Categorizing Expenses and Setting Up Recurring Payments

Properly categorizing expenses is essential for accurate financial reporting. To categorize expenses in QuickBooks and set up recurring payments:

- Create expense categories: Define expense categories that align with your business needs.

- Assign expenses to categories: Categorize each expense transaction in QuickBooks to track spending effectively.

- Set up recurring payments: Automate recurring expenses such as subscriptions or utilities to save time and ensure timely payments.

Best Practices for Efficient Expense Management

To efficiently manage and track expenses in QuickBooks, consider the following best practices:

- Regularly review and reconcile expenses: Stay on top of your expenses by reviewing and reconciling transactions frequently.

- Utilize reports: Generate expense reports in QuickBooks to analyze spending patterns and make informed financial decisions.

- Integrate with apps: Explore integrations with expense management apps to streamline the expense tracking process further.

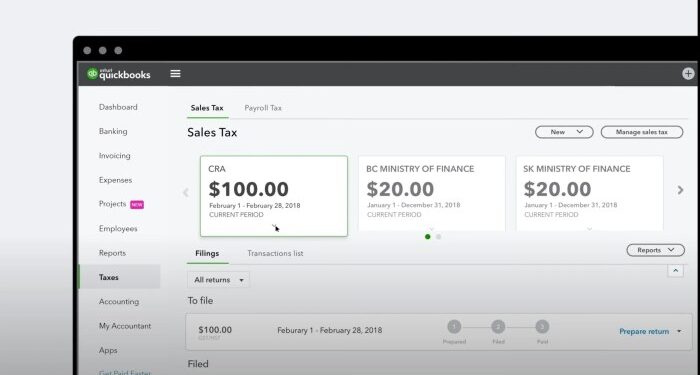

Generating Tax Reports

Generating tax reports in QuickBooks is crucial for solo entrepreneurs to accurately track and report their financial information for tax filing purposes. These reports provide a comprehensive overview of income, expenses, deductions, and other financial details that are essential for tax preparation.

Types of Tax Reports

- Profit and Loss Statement: This report summarizes your business's income, expenses, and net profit over a specific period, providing a snapshot of your financial performance.

- Balance Sheet: The balance sheet shows your business's assets, liabilities, and equity at a specific point in time, giving a clear picture of your financial health.

- Sales Tax Report: This report details the sales tax collected on taxable sales and helps ensure compliance with tax regulations.

- Income Tax Summary: Summarizes your taxable income, deductions, and credits, providing a comprehensive view of your tax liability.

Customizing Tax Reports

QuickBooks allows solo entrepreneurs to customize tax reports to meet specific tax requirements by adjusting settings and filters to include or exclude specific information. Here's how you can customize tax reports:

- Go to the Reports menu in QuickBooks and select the desired tax report.

- Click on the Customize button to access customization options such as date range, columns, and filters.

- Modify the report settings to include or exclude specific accounts, categories, or transactions based on your tax reporting needs.

- Save the customized report for future use or export it in various formats for tax filing purposes.

Integrating QuickBooks with Tax Filing Software

Integrating QuickBooks with tax filing software can offer numerous benefits to solo entrepreneurs. It helps in streamlining the tax preparation process, reducing errors, saving time, and ensuring accurate financial data transfer.

Connecting QuickBooks to Tax Software for Seamless Data Transfer

When integrating QuickBooks with tax filing software, follow these steps for seamless data transfer:

- Choose a compatible tax filing software that works well with QuickBooks.

- Log in to your QuickBooks account and navigate to the settings or integration section.

- Look for the option to connect or integrate with tax software and follow the on-screen instructions.

- Authorize the data transfer between QuickBooks and the tax software by granting permission.

- Review the connected accounts to ensure the integration is successful.

Recommendations for Popular Tax Filing Software

Some popular tax filing software that work well with QuickBooks include:

| Tax Software | Features |

|---|---|

| Intuit TurboTax | Seamless integration with QuickBooks, step-by-step guidance, and accurate calculations. |

| H&R Block | User-friendly interface, expert support, and compatibility with QuickBooks. |

| TaxAct | Affordable pricing, import capabilities from QuickBooks, and various tax filing options. |

Final Wrap-Up

Concluding our exploration of automating taxes using QuickBooks for solo entrepreneurs, this summary encapsulates the key takeaways and highlights the importance of leveraging technology for seamless tax preparation and filing. Dive into the world of automated tax management with confidence and ease!

Key Questions Answered

How can QuickBooks streamline tax processes for solo entrepreneurs?

QuickBooks offers features specifically designed for solo entrepreneurs, making it easier to track income, manage expenses, and generate tax reports efficiently.

What is the importance of accurate data entry in QuickBooks for tax automation?

Accurate data entry is crucial for ensuring that tax reports are generated correctly and that the tax filing process is smooth and error-free.

How can one customize income tracking features in QuickBooks?

Users can customize income tracking by setting up categories, adding specific income sources, and tailoring reports to meet their unique tax requirements.

Which tax filing software integrates well with QuickBooks?

Popular tax filing software like TurboTax and TaxAct seamlessly integrate with QuickBooks, allowing for easy data transfer and streamlined tax preparation.