Diving into the realm of smart finance tools for global business owners, this introduction sets the stage for an insightful exploration of how technology is transforming financial management practices worldwide.

In the following paragraphs, we will delve into the key features, popular tools, integration with business operations, security measures, cost-benefit analysis, and more in the context of global business ownership.

Smart Finance Tools Overview

Smart finance tools for global business owners are innovative technological solutions designed to streamline and optimize financial management processes. These tools leverage automation, data analytics, and cloud technology to provide real-time insights and facilitate informed decision-making.

Key Features of Smart Finance Tools

- Automation of repetitive tasks such as invoicing, expense tracking, and financial reporting.

- Integration with bank accounts and financial institutions for seamless transaction monitoring.

- Data analytics capabilities for generating detailed financial reports and forecasting future trends.

- Cloud-based storage for secure access to financial data from anywhere, anytime.

- Customizable dashboards and alerts for monitoring key financial metrics and performance indicators.

Importance of Technology in Financial Management

Utilizing technology in financial management is crucial for businesses to stay competitive and agile in today's fast-paced global market. Smart finance tools enable businesses to enhance efficiency, accuracy, and transparency in financial operations, ultimately leading to improved financial performance and sustainable growth.

Popular Smart Finance Tools

When it comes to managing finances for a global business, there are several smart finance tools available in the market that can simplify the process and provide valuable insights. These tools offer a range of functionalities designed to help business owners make informed decisions and optimize their financial strategies.

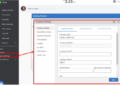

Xero

Xero is a cloud-based accounting software that is popular among global business owners for its user-friendly interface and comprehensive features. It allows users to manage invoicing, payroll, expenses, and cash flow in one platform. The real-time financial data provided by Xero helps business owners track their performance and make data-driven decisions.

QuickBooks Online

QuickBooks Online is another widely used finance tool that offers features such as invoicing, expense tracking, and financial reporting. It is known for its ease of use and integration with other business tools, making it a convenient option for global business owners looking to streamline their financial processes.

Zoho Books

Zoho Books is a smart finance tool that caters to businesses of all sizes, offering features like automated workflows, project tracking, and inventory management. It is praised for its affordability and scalability, making it a popular choice for global business owners looking for a customizable finance solution.

Wave

Wave is a free accounting software that provides essential features like invoicing, receipt scanning, and financial reporting. It is especially favored by small business owners and freelancers due to its simplicity and cost-effectiveness. Wave's user-friendly interface makes it easy for global business owners to manage their finances efficiently.

Integration with Business Operations

Smart finance tools play a crucial role in enhancing the efficiency and effectiveness of various business operations. By integrating these tools into different aspects of financial management, global business owners can streamline processes, improve decision-making, and ultimately optimize their overall performance.

Automated Invoicing and Payment Processing

Automated invoicing and payment processing tools are essential for global businesses to ensure timely payments and accurate financial records. These tools can automatically generate invoices, send payment reminders, and reconcile transactions, reducing the manual work required and minimizing errors in the process.

- Automated invoicing tools like FreshBooks or QuickBooks allow business owners to create and send professional invoices with just a few clicks, eliminating the need for manual entry and reducing the risk of errors.

- Payment processing tools such as PayPal or Stripe enable businesses to accept payments from customers worldwide, offering secure and convenient payment options that can be integrated into e-commerce platforms or websites.

- By automating these processes, businesses can speed up cash flow, improve customer satisfaction, and free up valuable time that can be redirected towards strategic decision-making and business growth.

Expense Management and Budgeting

Smart finance tools also help global businesses manage expenses and budgets more efficiently, allowing for better control over financial resources and improved cost management strategies.

- Expense tracking tools like Expensify or Zoho Expense provide businesses with a centralized platform to monitor and categorize expenses, track receipts, and generate expense reports for better decision-making.

- Budgeting tools such as Mint or YNAB help businesses set financial goals, create budgets, and track spending in real-time, allowing for a more proactive approach to financial management and planning.

- By leveraging these tools, business owners can gain better visibility into their financial health, identify cost-saving opportunities, and make informed decisions to optimize their budgets and achieve their financial objectives.

Security and Compliance

Data security and compliance are crucial aspects to consider when utilizing smart finance tools for global business operations. Ensuring the protection of sensitive financial information and adhering to regulations are vital for maintaining the trust of customers, partners, and stakeholders.

Importance of Data Security

- Implementing strong encryption protocols to safeguard financial data from unauthorized access.

- Regularly updating software and systems to patch vulnerabilities and prevent cyber threats.

- Restricting access to financial information only to authorized personnel with secure login credentials.

Common Security Risks

- Phishing attacks targeting employees to steal login credentials and gain access to financial systems.

- Ransomware threats that can encrypt financial data and demand payment for decryption.

- Data breaches resulting from weak passwords, insecure networks, or unsecured devices.

Best Practices for Compliance

- Understanding and complying with data protection regulations such as GDPR, HIPAA, or PCI DSS.

- Regularly conducting security assessments and audits to identify vulnerabilities and ensure compliance.

- Training employees on data security best practices and protocols to prevent human errors or negligence.

Cost-Benefit Analysis

Implementing smart finance tools for global business owners involves a cost-benefit analysis to determine the potential savings and efficiency gains. This analysis helps in measuring the return on investment and assessing the overall impact of these tools on the business.

Potential Savings and Efficiency Gains

- Automation of financial processes can lead to significant time savings for employees, allowing them to focus on more strategic tasks.

- Reduction in manual errors can result in cost savings by avoiding financial discrepancies and potential penalties.

- Improved financial visibility and real-time data analysis can lead to better decision-making and strategic planning.

Measuring Return on Investment

- Calculate the initial investment in smart finance tools, including implementation costs and training expenses.

- Estimate the potential cost savings and efficiency gains over a specific period, considering factors like increased productivity and reduced errors.

- Compare the projected benefits with the initial investment to determine the return on investment percentage.

Closure

In conclusion, the discussion on smart finance tools for global business owners sheds light on the innovative solutions available for enhancing financial management efficiency and security in the modern business landscape.

FAQ Section

How can smart finance tools benefit global business owners?

Smart finance tools offer advanced features that streamline financial processes, enhance efficiency, and provide valuable insights for informed decision-making.

What are some popular smart finance tools in the market?

Popular smart finance tools include Xero, QuickBooks, FreshBooks, and Wave, each offering unique functionalities tailored to different business needs.

How can smart finance tools be integrated into business operations?

Smart finance tools can be seamlessly integrated into various aspects of business operations, such as budgeting, invoicing, expense tracking, and financial reporting.

What security measures should global business owners consider when using smart finance tools?

Global business owners should prioritize data encryption, multi-factor authentication, regular security updates, and compliance with data protection regulations to ensure the security of financial information.

How can global business owners measure the return on investment of implementing smart finance tools?

Global business owners can measure the return on investment by analyzing cost savings, efficiency gains, improved decision-making capabilities, and overall financial performance enhancements achieved through the adoption of smart finance tools.