Delving into the realm of choosing the right business line of credit in 2025, this introduction aims to pique the interest of readers with valuable insights and essential considerations.

Exploring the nuances of credit options and financial decisions in the upcoming year sets the stage for informed decision-making in the business world.

Factors to Consider When Choosing a Business Line of Credit

When choosing a business line of credit, there are several key factors to consider to ensure it aligns with your business needs and financial goals.

Assessing the Credit Limit Needed for the Business

- It is crucial to evaluate the credit limit required for your business operations. Consider factors such as ongoing expenses, inventory needs, and potential growth opportunities.

- Ensure the credit limit is sufficient to cover your business's financial needs without exceeding what is necessary, as this can lead to unnecessary debt and financial strain.

Impact of Interest Rates on Different Types of Credit Lines

- Interest rates can vary significantly among different types of credit lines, such as traditional bank loans, business credit cards, or online lenders.

- Consider the impact of interest rates on the overall cost of borrowing and how it will affect your business's cash flow and profitability.

- Compare interest rates from various lenders to choose a business line of credit with competitive terms that align with your financial objectives.

Repayment Terms Influence on the Choice of a Business Line of Credit

- Repayment terms, such as the repayment period and frequency of payments, play a critical role in selecting the right business line of credit.

- Evaluate the flexibility of repayment terms offered by different lenders to ensure they match your business's cash flow and revenue cycles.

- Choose a business line of credit with repayment terms that are manageable and sustainable for your business to avoid financial strain and potential default.

Types of Business Lines of Credit Available in 2025

In 2025, businesses have a variety of options when it comes to choosing a line of credit. Understanding the differences between traditional bank lines of credit and online lenders, as well as the features of secured versus unsecured lines of credit, can help businesses make the right choice for their financial needs.

Traditional Bank Lines of Credit vs. Online Lenders

Traditional bank lines of credit are typically offered by brick-and-mortar banks and have been a longstanding option for businesses seeking financing. These lines of credit often come with strict requirements, such as a good credit score and collateral. On the other hand, online lenders provide a more streamlined application process and may be more accessible to businesses with less-than-perfect credit.

Secured Business Line of Credit vs. Unsecured Business Line of Credit

A secured business line of credit requires collateral, such as business assets or real estate, to secure the credit line. This can result in lower interest rates and higher credit limits. In contrast, an unsecured business line of credit does not require collateral but may come with higher interest rates and lower credit limits.

Revolving Line of Credit vs. Term Loan

A revolving line of credit allows businesses to borrow up to a certain limit, repay the borrowed amount, and then borrow again. This flexibility makes it a popular choice for businesses with varying cash flow needs. In comparison, a term loan provides a lump sum of money upfront, which is repaid over a set period of time with fixed payments.

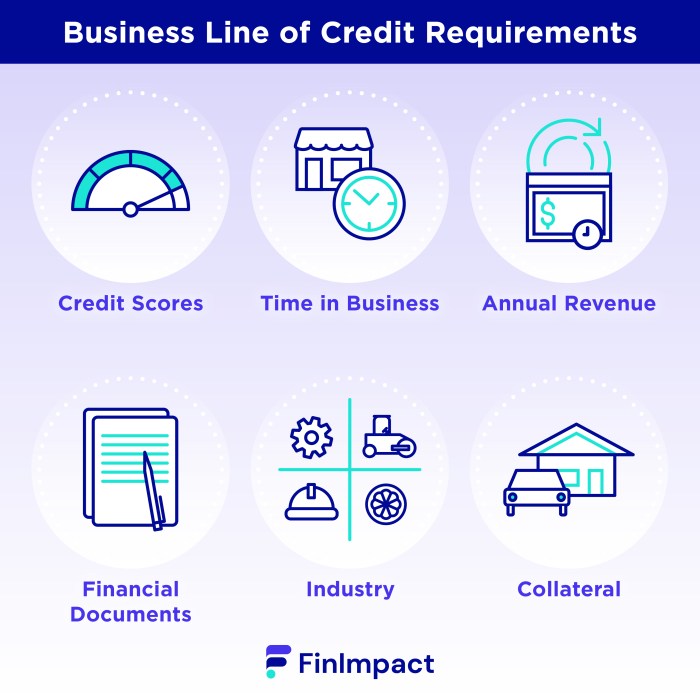

Application Process and Approval Criteria for Business Lines of Credit

When applying for a business line of credit, there are specific documentation requirements that businesses need to fulfill. These documents are essential for lenders to assess the creditworthiness of the business and make an informed decision regarding the approval of the credit line.

Documentation Required for Applying for a Business Line of Credit

- Business financial statements, including income statements and balance sheets

- Tax returns for the business

- Business plan outlining the purpose of the line of credit and how it will be utilized

- Proof of business ownership and legal structure

- Personal financial information of business owners or guarantors

Impact of Business Credit Score on Approval of Credit Line

- A business's credit score plays a crucial role in determining the approval of a business line of credit. Lenders use the credit score to assess the risk associated with lending to the business.

- A higher credit score indicates a lower risk for the lender, making it more likely for the business to be approved for a credit line with favorable terms.

- On the other hand, a lower credit score may result in either a higher interest rate, lower credit limit, or even rejection of the credit line application.

Role of Business Financials in Determining Eligibility for a Line of Credit

- Business financials, such as income statements and balance sheets, provide lenders with insights into the financial health and stability of the business.

- Lenders analyze these financial documents to assess the ability of the business to repay the borrowed funds and manage the credit line responsibly.

- A strong financial performance demonstrated through these documents can increase the likelihood of approval for a business line of credit with competitive terms.

Managing and Maximizing a Business Line of Credit

Businesses need to implement effective strategies to manage their business line of credit responsibly in order to avoid accumulating unnecessary debt. This involves careful planning and monitoring of expenses to ensure that the credit line is used wisely and strategically.

At the same time, businesses can leverage their credit line to fund growth and expansion opportunities, ultimately maximizing the benefits of having access to additional capital for their operations.

Strategies for Effective Management of a Business Line of Credit

- Regularly monitor spending and track expenses to avoid overspending and accumulating unnecessary debt.

- Set a budget and stick to it to ensure that the credit line is used for essential business expenses only.

- Negotiate favorable terms with the lender to secure the best possible interest rates and repayment terms.

- Establish a contingency plan in case of unforeseen financial challenges to avoid defaulting on the credit line.

Leveraging a Credit Line for Growth and Expansion

- Use the credit line to invest in new equipment, technology, or infrastructure that can help the business expand its operations.

- Explore opportunities for business development, such as entering new markets or launching new products/services, using the credit line as a financial resource.

- Consider mergers or acquisitions as a strategic way to grow the business with the help of additional capital from the credit line.

Tips for Maximizing the Benefits of a Business Line of Credit

- Utilize the credit line for short-term financing needs, such as managing cash flow during slow seasons or covering unexpected expenses.

- Repay the borrowed funds promptly to maintain a good credit standing and increase the likelihood of securing higher credit limits in the future.

- Regularly review the terms of the credit line to ensure that it still aligns with the business's financial goals and needs.

- Consult with financial advisors or accountants to develop a strategic plan for utilizing the credit line effectively and responsibly.

Closure

In conclusion, navigating the landscape of business lines of credit in 2025 requires careful evaluation and strategic planning. By understanding the key factors and types of credit available, businesses can make informed decisions to support their growth and financial stability.

FAQ Section

What is the significance of assessing the credit limit needed for a business line of credit?

Assessing the credit limit needed helps businesses borrow the right amount to meet their financial needs without overextending themselves.

How does a business's credit score impact the approval of a credit line?

A business's credit score plays a crucial role in determining the creditworthiness and risk associated with lending, affecting the approval of a credit line.

What strategies can businesses employ to effectively manage a business line of credit and avoid debt?

Businesses can manage their credit lines effectively by monitoring spending, making timely payments, and avoiding unnecessary borrowing to prevent accumulating debt.