Embark on the journey of Opening a Global Business Bank Account with this comprehensive Step-by-Step Guide. This introduction sets the stage for an insightful exploration of the intricacies involved in establishing an international banking presence, using a casual formal language style to engage and inform readers.

The subsequent paragraph will delve into the specifics of the topic, providing valuable insights and practical advice.

Researching Global Business Bank Account Options

Researching different global bank account options is crucial for any business looking to establish a presence on an international scale. It allows you to find a financial institution that aligns with your specific needs and goals, ensuring smooth operations and financial management across borders.

Key Factors to Consider When Comparing Different Banks

- Interest Rates: Compare interest rates offered by different banks to maximize returns on your deposits.

- Fees and Charges: Analyze the fee structure of each bank to avoid unexpected costs that could impact your bottom line.

- Online Banking Capabilities: Consider the efficiency and security of online banking platforms for seamless transaction management.

- Currency Exchange Services: Evaluate the bank's currency exchange rates and services for international transactions.

- Customer Support: Look for banks with reliable customer support to address any concerns promptly.

Significance of Choosing a Bank with a Strong Global Network

Opting for a bank with a robust global network can offer several advantages for your business:

-

Access to International Markets: A bank with a strong global presence can provide insights and connections to new markets, facilitating business expansion.

-

Reduced Transaction Costs: With partnerships in multiple countries, you may benefit from lower fees and better exchange rates for cross-border transactions.

-

Global Support: Having access to branches or partners worldwide can enhance your business's operational efficiency and support network.

Understanding Documentation Requirements

When opening a global business bank account, it is crucial to understand the documentation requirements to ensure a smooth process and avoid any delays or complications.Having all the necessary documentation in order before initiating the account opening process is essential to demonstrate the legitimacy of your business and comply with regulatory requirements.

It also helps build trust with the bank and facilitates the verification process.

List of Necessary Documents:

- Certificate of Incorporation: This document proves the existence of your business and provides details about its structure and ownership.

- Proof of Identity: Valid identification documents of all account signatories, such as passports or national IDs.

- Proof of Address: Utility bills, lease agreements, or other documents verifying the physical address of the business.

- Business Plan: A detailed Artikel of your business operations, target market, financial projections, and other relevant information.

- Tax Identification Number (TIN): Official documentation showing your business's TIN or equivalent tax identification information.

Varying Requirements by Country/Region:

In some countries or regions, additional documentation may be required depending on local regulations and banking practices. For example, certain jurisdictions may ask for specific permits or licenses related to your business activities. It is important to research and understand the specific requirements of the country or region where you plan to open a global business bank account to ensure compliance.

Meeting Eligibility Criteria

When it comes to opening a global business bank account, meeting the eligibility criteria is crucial. Banks have specific requirements that need to be met in order to open an account, and failing to meet these criteria can result in delays or even rejection of your application.

Common Eligibility Criteria

- Legal Business Entity: You must have a registered legal business entity in the country where you are applying for the account.

- Proof of Business Activities: You may need to provide documentation showing your business activities, such as invoices, contracts, or business licenses.

- Compliance with Anti-Money Laundering (AML) Regulations: You must comply with AML regulations and provide any necessary documentation to prove the legitimacy of your business.

- Minimum Deposit Requirements: Some banks may require a minimum initial deposit to open a business account.

- Good Credit History: Your business credit history may be checked to ensure financial stability.

How Meeting Criteria Impacts Account Opening

Meeting these eligibility criteria can greatly impact the ease of opening a global business bank account. When you meet all the requirements, the bank will have more confidence in your business and be more likely to approve your application promptly.

Failing to meet any of the criteria could result in delays, additional requests for information, or even rejection of your application.

Tips to Ensure Eligibility

- Organize Your Documentation: Make sure you have all the necessary documentation in order before applying for a global business bank account.

- Understand the Requirements: Take the time to understand the specific eligibility criteria of the bank you are applying to, and ensure you meet each requirement.

- Seek Professional Advice: If you are unsure about any of the criteria or documentation needed, consider seeking advice from a financial advisor or legal professional.

- Maintain Good Financial Standing: Keep your business finances in order and maintain a good credit history to enhance your chances of meeting eligibility criteria.

Choosing the Right Bank for Your Business

When it comes to opening a global business bank account, choosing the right bank is crucial. Your choice can impact your business operations, fees, and overall financial management. Here are some key points to consider when selecting a bank that aligns with your business needs and goals.

Comparing Different Banks

- Compare the services offered by different banks, such as online banking, international wire transfers, foreign currency accounts, and customer support.

- Examine the fee structure of each bank, including account maintenance fees, transaction fees, and currency conversion fees.

- Consider the global presence of the bank and whether they have branches or partner banks in countries where you conduct business.

Evaluating Reputation and Reliability

- Look into the reputation of the bank by checking reviews, ratings, and customer feedback online.

- Verify the reliability of the bank by researching their financial stability, security measures, and compliance with regulations.

- Consider the bank's track record in serving businesses similar to yours and their experience in handling international transactions.

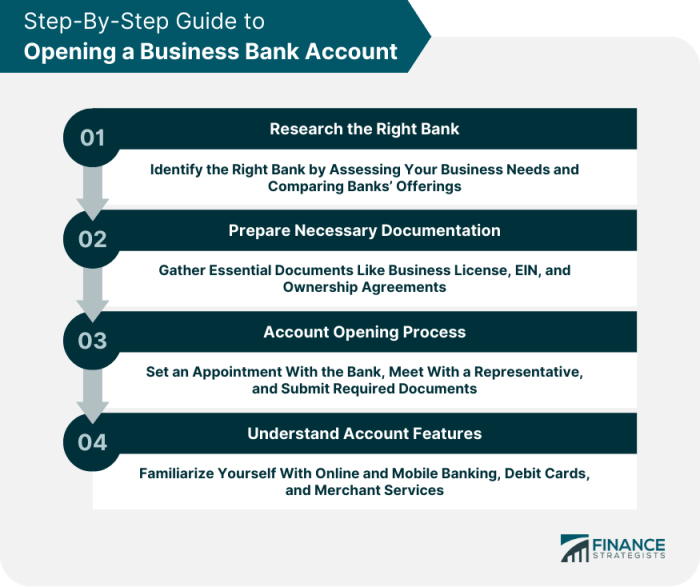

Initiating the Account Opening Process

Opening a global business bank account involves several steps that need to be followed diligently. Here is a breakdown of the process and what you can expect along the way.

Step-by-Step Guide

- Begin by contacting the chosen bank to express your interest in opening a global business account. Provide them with all necessary information about your business.

- Prepare all required documents such as proof of identity, business incorporation documents, financial statements, and any other relevant paperwork.

- Schedule a meeting with a bank representative either in person or virtually to discuss your account opening requirements and to clarify any doubts.

- Fill out the application form provided by the bank, ensuring all details are accurate and up to date.

- Submit the completed application form along with all required documents to the bank for review and processing.

- Wait for the bank to conduct their due diligence process which may involve background checks and verification of the information provided.

- Once your application is approved, the bank will provide you with the account details and necessary steps to activate your global business account.

What to Expect

- During the account opening process, you can expect the bank to ask for additional information or clarification on certain documents. Be prepared to provide prompt responses to avoid delays.

- The bank may also require you to meet specific financial criteria or maintain a minimum balance in the account. Ensure you are aware of these requirements beforehand.

- There might be delays in the processing of your account opening due to various factors such as incomplete documentation or additional verification needed. Patience is key during this stage.

Effective Communication with Bank Representatives

- Always maintain clear and open communication with the bank representatives throughout the account opening process. Address any concerns or queries promptly to avoid misunderstandings.

- Follow up on the progress of your application regularly to ensure that everything is moving forward smoothly. This will also demonstrate your commitment to the bank.

- Be professional and courteous in all your interactions with the bank representatives, as this will create a positive impression and potentially expedite the account opening process.

Managing Compliance and Regulatory Requirements

Opening a global business bank account comes with the responsibility of adhering to international banking regulations. Compliance with these regulations is crucial to ensure the legality and smooth operation of your account.

Key Compliance Requirements

- Anti-money laundering (AML) regulations: Businesses must provide detailed information about the source of funds to prevent money laundering activities.

- Know Your Customer (KYC) requirements: Banks require businesses to verify the identity of beneficial owners and key personnel to mitigate the risk of financial crimes.

- Tax compliance: Businesses need to ensure that they comply with tax laws in both their home country and the country where the account is held.

Ensuring Ongoing Compliance

Once your global business bank account is open, it is essential to maintain ongoing compliance with regulatory standards. Here are some tips to help you stay on track:

- Regularly review and update your documentation to reflect any changes in your business structure or ownership.

- Stay informed about any changes in international banking regulations that may affect your account.

- Work closely with your bank to address any compliance issues promptly and effectively.

Final Wrap-Up

Concluding this discussion on Opening a Global Business Bank Account: Step-by-Step Guide, we have navigated through the essential steps and considerations necessary for a successful international banking venture. The summary encapsulates the key points discussed, leaving readers with a clear understanding of the process.

FAQ Explained

What documents are required for opening a global business bank account?

Commonly required documents include proof of identity, proof of address, business registration documents, and financial statements.

What factors should I consider when choosing a bank for my global business account?

Key factors to consider include the bank's global network, services offered, fees, reputation, and compatibility with your business needs.

What are common eligibility criteria for opening a global business bank account?

Common eligibility criteria often include proof of business registration, minimum balance requirements, and compliance with anti-money laundering regulations.

How can I ensure ongoing compliance with regulatory standards after opening a global business bank account?

To maintain compliance, businesses should stay informed of regulatory changes, conduct regular audits, and ensure proper record-keeping.