Secure Your Startup: The Best Business Credit Lines in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Business credit lines are vital for the growth of startups, providing them with the financial flexibility needed to thrive in a competitive market. In this article, we will explore the top business credit lines in 2025 and how they can help secure the future of your startup.

Introduction to Business Credit Lines

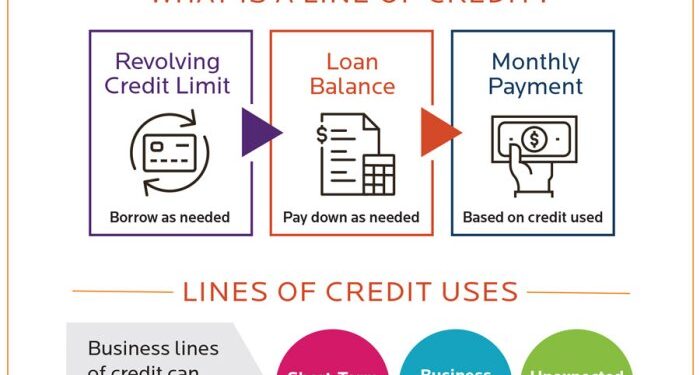

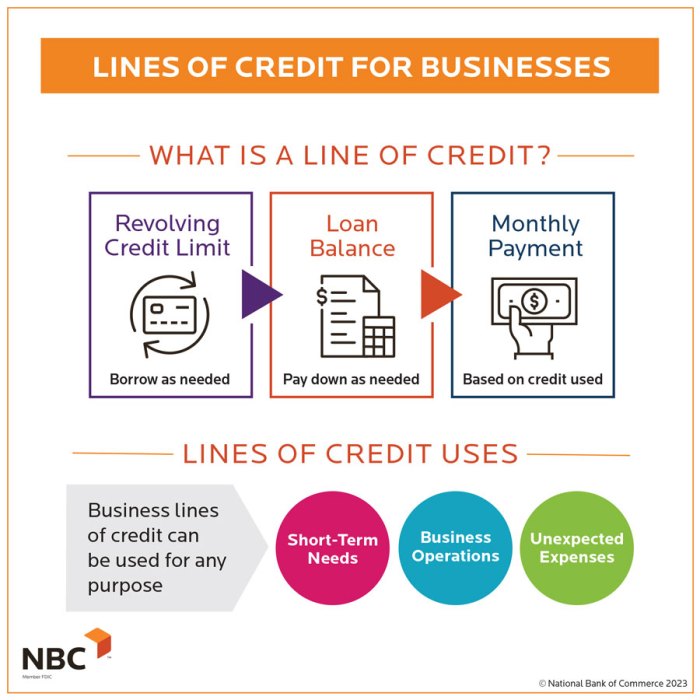

Business credit lines are a type of financing that provides a revolving line of credit to businesses, allowing them to borrow funds up to a predetermined limit. This form of credit is crucial for startups looking to manage cash flow, cover operational expenses, and invest in growth opportunities.

Types of Business Credit Lines

- Traditional Bank Lines of Credit: Offered by banks and financial institutions, these credit lines typically come with lower interest rates and are suitable for established startups with strong credit.

- Online Business Lenders: Alternative lenders provide quick access to credit lines with less stringent requirements, making them ideal for startups with limited credit history.

- Secured and Unsecured Lines of Credit: Secured credit lines require collateral, while unsecured credit lines do not, offering different risk levels for startups.

Importance of Securing a Business Credit Line

Securing a business credit line is essential for startup growth as it provides financial flexibility, helps build business credit, and allows for quick access to funds when needed. By establishing a credit line early on, startups can navigate financial challenges and seize growth opportunities with ease.

Benefits of Business Credit Lines for Startups

Business credit lines offer several advantages for startups compared to traditional loans. One of the main benefits is the flexibility they provide in terms of accessing funds as needed. Startups can draw funds up to a certain limit, repay, and then redraw without having to reapply for a new loan each time.

This flexibility is crucial for managing cash flow effectively and seizing opportunities for growth.

Lower Interest Rates

- Business credit lines often come with lower interest rates compared to traditional loans, making them a more cost-effective financing option for startups.

- This lower cost of borrowing can help startups save money in the long run and allocate more resources towards business growth and development.

Build Credit History

- Using a business credit line responsibly can help startups build a positive credit history, which is essential for securing larger financing options in the future.

- By making timely payments and managing credit wisely, startups can establish credibility with lenders and improve their chances of accessing more favorable terms in the future.

Quick Access to Funds

- Business credit lines provide startups with quick access to funds when needed, allowing them to respond to unexpected expenses or capitalize on opportunities without delay.

- This immediate access to funds can help startups navigate cash flow challenges and stay agile in a competitive business environment.

Success Stories

One notable success story is that of XYZ Tech, a startup that utilized a business credit line to finance a new product launch. By leveraging the credit line, XYZ Tech was able to scale production, increase marketing efforts, and successfully bring their product to market, leading to significant revenue growth.

Another example is ABC Fashion, which used a business credit line to secure inventory for the holiday season. This strategic financing decision allowed ABC Fashion to meet customer demand, boost sales, and establish a strong position in the market.

Factors to Consider When Choosing a Business Credit Line

When choosing a business credit line for your startup, several key factors need to be taken into consideration to ensure that you are making the best decision for your business's financial health.

Interest Rates

Interest rates play a crucial role in determining the overall cost of borrowing money through a business credit line. Lower interest rates can save your startup a significant amount of money in the long run, so it's essential to compare rates from different lenders and choose the most competitive option.

Credit Limits

The credit limit offered by a business credit line will determine how much funding you have access to when needed. It's important to assess your startup's financial needs and choose a credit line with a suitable credit limit that can support your business operations and growth.

Repayment Terms

Understanding the repayment terms of a business credit line is crucial to avoid any financial strain on your startup. Consider factors such as repayment schedules, penalty fees for late payments, and flexibility in repayment options when choosing a credit line that aligns with your business's cash flow and financial capabilities.

Credit Score and Financial History

Your credit score and financial history play a significant role in whether your startup will be approved for a business credit line. Lenders use this information to assess your creditworthiness and determine the terms of the credit line. It's essential to maintain a good credit score and financial track record to improve your chances of approval and secure favorable terms.

Tips for Approval

- Regularly monitor and improve your credit score by paying bills on time and reducing outstanding debt.

- Prepare a detailed business plan that demonstrates your startup's potential for growth and profitability.

- Provide accurate financial statements and business documentation to lenders to showcase your startup's financial stability and management.

- Consider establishing a relationship with a lender or financial institution that offers business credit lines to improve your chances of approval.

Top Business Credit Lines for Startups in 2025

When it comes to choosing a business credit line for your startup, it's essential to consider the features and benefits that each option offers. Here are some of the best business credit lines available for startups in 2025:

1. Chase Ink Business Unlimited

- Features:

- No annual fee

- Unlimited 1.5% cash back on all purchases

- Introductory 0% APR for the first 12 months

- Benefits:

- Flexible cash back rewards

- No minimum redemption amount

- Employee cards at no additional cost

- Special Offers:

- $750 cash back bonus after spending $7,500 in the first 3 months

- Additional employee cards with customizable spending limits

2. American Express Blue Business Cash Card

- Features:

- No annual fee

- 2% cash back on all eligible purchases up to $50,000 per year

- Introductory 0% APR for the first 12 months

- Benefits:

- High cash back rewards rate

- No category restrictions

- Expanded buying power

- Special Offers:

- Introductory cash back bonus for new cardholders

- Amex Offers for additional savings at select merchants

3. Bank of America Business Advantage Unlimited Cash Rewards

- Features:

- No annual fee

- Unlimited 1.5% cash back on all purchases

- Introductory 0% APR for the first 9 billing cycles

- Benefits:

- No expiration on cash back rewards

- Online and mobile banking tools for easy account management

- Overdraft protection option

- Special Offers:

- Introductory bonus cash rewards for new cardholders

- Customizable employee cards with spending controls

Closing Notes

As we wrap up our discussion on Secure Your Startup: The Best Business Credit Lines in 2025, it becomes evident that choosing the right credit line can make a significant impact on the success of your startup. By understanding the benefits, factors to consider, and top options available, you can confidently navigate the world of business credit lines and propel your startup towards success.

FAQ Compilation

What are the key factors to consider when choosing a business credit line?

Key factors include interest rates, credit limits, repayment terms, credit score requirements, and financial history. It's important to evaluate these aspects to select the most suitable credit line for your startup.

How can startups improve their chances of approval for a credit line?

Startups can enhance their approval odds by maintaining a good credit score, demonstrating a solid financial history, and providing a clear business plan that showcases their potential for growth and success.

Are there any special offers or incentives that business credit lines offer for startups?

Some business credit lines may provide perks such as introductory 0% APR periods, cash back rewards, or waived annual fees for startups. It's essential to explore these incentives to maximize the benefits of the credit line.